As AI continues to disrupt the financial world, one question is gaining traction: Can ChatGPT truly replace your financial advisor? With advanced language models offering financial simulations and advice-like answers, many are tempted to switch from human experts to intelligent machines.

Let’s explore what ChatGPT can do, where it falls short, and how you can use both AI and human insight to build a powerful financial strategy.

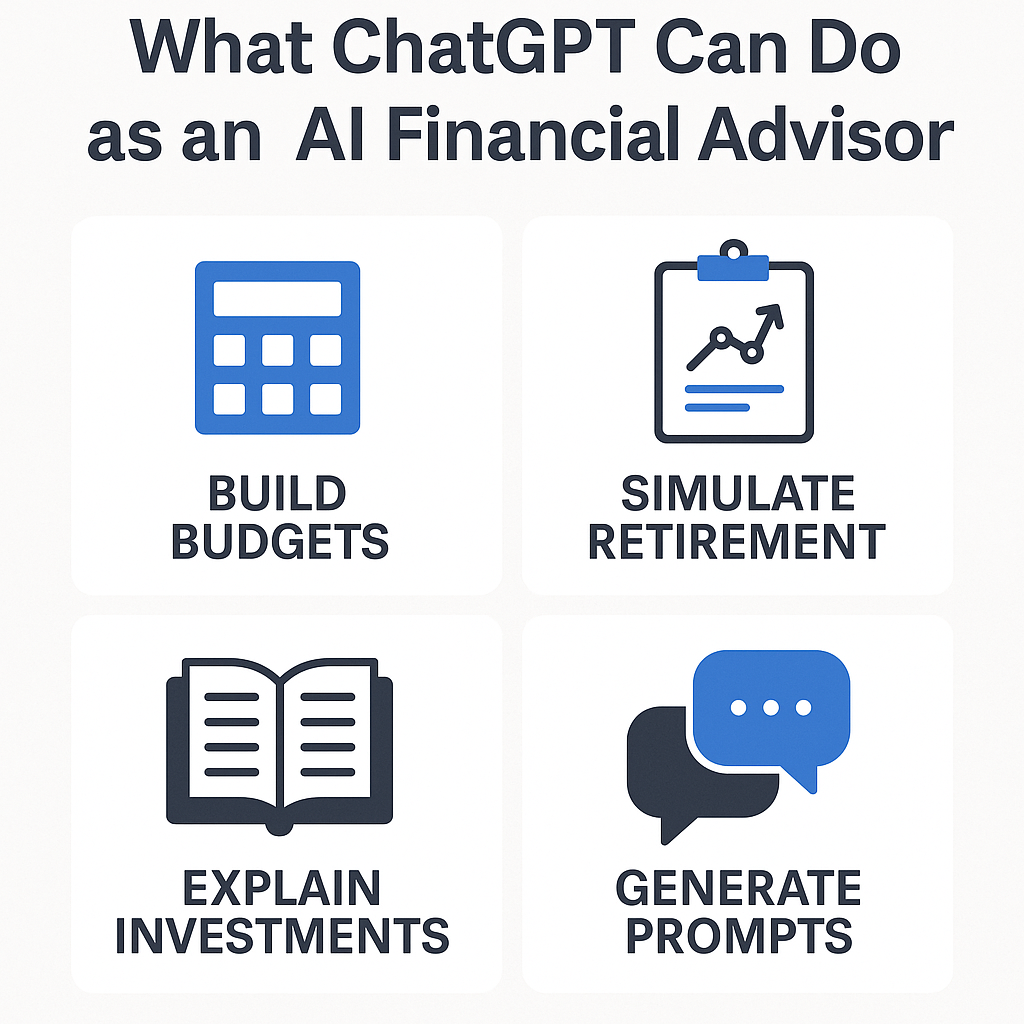

What Can ChatGPT Do as an AI Financial Advisor?

ChatGPT is trained on a massive amount of financial data, enabling it to:

- Build detailed budgets based on income, expenses, and goals.

- Explain investment vehicles like ETFs, IRAs, and 401(k)s in plain language.

- Simulate retirement outcomes or debt repayment plans.

- Generate customized prompts to help prepare for advisor meetings.

In short, it’s like having a financial research assistant at your fingertips.

If you’re new to AI and want to start using it for financial or passive income strategies, check out our post on 6 Ways to Earn Money with AI.

Limitations of Relying Solely on AI for Financial Advice

Despite its intelligence, ChatGPT is not a certified financial planner or fiduciary. Key limitations include:

- No legal obligation to act in your best interest.

- Lack of emotional intelligence and life context.

- No accountability—it won’t follow up or monitor market changes.

- Unlicensed for tax, legal, or estate advice.

AI can guide you, but it doesn’t replace professionals when lives and legacies are involved.

Want to learn how to use AI more strategically in your investment journey? Visit our guide on How to Use AI for Investments.

How to Use ChatGPT and a Human Financial Advisor Together

The best use of ChatGPT in 2025 isn’t replacing human advisors—it’s enhancing your decision-making.

Use ChatGPT to:

- Craft early-stage financial plans

- Clarify concepts before advisor meetings

- Test “what if” scenarios instantly

- Draft financial blog content for your own knowledge or business

Want to turn that knowledge into cash flow? See how we teach creators to Make Serious Money Blogging with AI.

Use a human advisor to:

- Fine-tune investment strategies

- Create multi-generational wealth plans

- Interpret legal or tax laws

- Provide accountability and course correction

Together, they offer a best-of-both-worlds approach.

ChatGPT Prompts to Elevate Your Financial Planning

If you’re ready to experiment, try these prompts:

- “Build a 50/30/20 budget plan for someone earning $70,000 a year.”

- “Compare Roth IRA vs Traditional IRA for a 35-year-old entrepreneur.”

- “Outline a financial freedom plan for a remote freelancer.”

- “Create a financial literacy checklist for Gen Z.”

- “Suggest diversified ETF portfolios for moderate risk profiles.”

For more practical guidance, take a look at Netguru’s Mastering AI Personal Finance Guide.

Final Thoughts: ChatGPT vs. Financial Advisor in 2025

ChatGPT is powerful. It offers speed, knowledge, and convenience. But when it comes to emotion, complexity, and accountability, human advisors still win.

The future of finance isn’t AI vs. humans—it’s AI and humans. Your smartest move is using ChatGPT to become a better-informed client, while trusting the execution and strategy to licensed pros.

To dig deeper into the ethics and security risks of AI finance tools, we recommend this detailed breakdown by Redress Compliance.

Want to start using AI for your own budgeting or investment planning?

Subscribe to our free newsletter and get access to our new up and coming 2025 AI Budgeting Toolkit—complete with custom prompts, templates, and strategy guides.